Among the things most Americans have long seemed to believe about our country is the idea that in some sense, we’re all part of one big team. Nods to national unity are common, and surely it isn’t hard to recall how, in the days following the terrorist attacks of 9/11, millions of Americans slapped bumper stickers on their cars sporting the slogan united we stand. One part nationalistic and militaristic hubris, one part a genuine expression of emotional empathy with the victims and their families, the slogan and the concept behind it spoke to a deep-seated component of the nation’s ideology: the notion of reciprocity, or, more simply put, the idea that “we’re all in this together.”

Of course, in the wake of the 9/11 tragedy not all Americans shared this sentiment equally, and there was a marked gap between the willingness of white Americans to adorn their vehicles in such a manner and that of people of color. Non-whites, more viscerally aware of the ongoing inequities between their own life conditions and those of most in the white majority, were not as likely to sport such stickers or engage in the flag-waving that became so commonplace in the aftermath of the attacks. Unity, after all, is not something that can be wished into existence, or something that manifests simply because a tragedy has transpired. For many African Americans and other people of color there had been many 9/11s, so to speak, throughout their history on this continent, none of which had brought real unity or equity of experience.

That said, and with exceptions duly noted, the notion of unity, togetherness and reciprocity is something to which we have all been exposed and to varying degrees have likely internalized. While the ideology of unity and reciprocity hardly fits with the lived reality of those belonging to marginalized groups, the aspirational if not existential lure of the dominant narrative remains strong, so much so that many of our most recognizable national slogans over the years conjure this notion, from “What’s good for General Motors is good for America” to “A rising tide lifts all boats.”

Yet, in recent years, the idea that America is one big team has been increasingly difficult to accept, because of the rapidity with which disparities of income and wealth have been growing, opening up a vast chasm between the nation’s wealthiest and everyone else. Between late 2007 and 2009, the economy imploded, doubling unemployment rates and destroying more than a third of the nation’s housing value (particularly among the middle and working class), and yet Wall Street profits rose by 720 percent.79 When the majority of the American people can be thrown into the worst economic situation of the past seventy-five years, even as a small economic minority can enjoy massive profits due to their deliberate and predatory actions, the idea of America being one big unified homeland becomes almost impossible to swallow.

Economic injustice, though increasingly exposed since the onset of the Great Recession, has been emerging as a serious and intractable national problem for several decades. Whereas incomes of those in all income quintiles grew together from the late 1940s until the late 1970s, after that period, incomes for all but those at the top began to stagnate.80 By 2007, right before the collapse of the economy, the richest one percent of Americans was already receiving twenty-three percent of national income. This nearly one-quarter share of national income was the highest percentage received by the top one percent since immediately prior to the onset of the Great Depression,81 and nearly three times the share that was being received by this wealthy group just thirty-one years earlier in 1976.82 From 1979 to 2007, the richest one percent of Americans (2.5 to 2.8 million people during that time) nearly quadrupled their average incomes. Meanwhile, the middle three-fifths of Americans only saw a forty percent gain in average incomes over that time—less than 1.5 percent income growth per year.83 From 1993 to 2012, adjusted for inflation, real incomes for the bottom ninety-nine percent of American families grew by less than seven percent while incomes for the wealthiest one percent nearly doubled.84

To put income inequality in graphic terms, consider that in 2013, 165,000 Wall Street bankers took home average bonuses of $162,000 each, resulting in an overall bonus bonanza of nearly $27 billion: that’s nearly double the amount taken home annually by all 1.1 million Americans working full-time at the minimum wage combined.85 Even more disturbing, the most successful hedge fund managers—a group that manages investment portfolios for the super-rich, and about whom there will be more to say later—quite typically can make in one single hour of work what the average American family earns in twenty-one years.86

Sadly, income inequality is only the tip of the iceberg when it comes to understanding the depths of disparity that plague modern America. Much more substantial is the vast inequity in tangible assets from which families derive long-term financial security. Wealth disparities, in other words, represent the much larger portion of the iceberg—the part that remains under the metaphorical water, often unseen. Even before the economy cratered, disparities in wealth—from housing value to stocks and bonds to commercial real estate—were already significant. Once the housing bubble burst, taking with it about $6 trillion in lost assets (and often the only assets held by middle-class and working-class Americans), that gulf grew even wider.87 As of 2010, the bottom half of the American population owned only about one percent of all national wealth, while the wealthiest one percent possessed more than a third of all wealth in the nation.88 As for those assets most likely to generate substantial income, meaning investment assets like stocks, financial securities, and business equity and trusts, the wealthiest one percent of Americans own just over half of all such assets in the nation.89 Today, wealth inequality in America stands at a level double that of the Roman Empire, where the top one percent owned about sixteen percent of all assets.90

However significant this level of disparity may sound, it actually understates the problem. Within the top one percent of wealth holders there is a big difference between those who barely make it into this group, and those at the pinnacle who reside in the top one-tenth (0.1) or top one-hundredth (0.01) of one percent. As of 2012, the top one-tenth of one percent (roughly 160,000 families) owned about twenty-two percent of the nation’s assets, which is equal to the share of national wealth possessed by the poorest ninety percent of Americans. Meanwhile, the richest one-hundredth of a percent (about 16,000 families) owned 11.2 percent of all national assets.91

To visualize what this means, we can analogize the distribution of wealth to the distribution of seats in a football stadium. Let’s imagine we were going to the Super Bowl in a stadium that seats 65,000 people. If the seats in the stadium were distributed the way that wealth is in America, just sixty-five fans would get to share 14,300 of the seats in the stadium. In fact, forget sharing seats: they could knock out the seats entirely and bring in big lounge chairs, umbrellas, Jacuzzis and their own personal cabanas instead. They would have so much space they could play Frisbee during commercial breaks or time-outs if they felt like it, never worrying about bumping up against the rest of us. Six or seven of these people would actually be able to cordon off 7,280 of these seats for themselves. This would leave the other fifty-seven or fifty-eight fans within the top 0.1 percent to fight over the remaining 7,020 seats (tough, but I suppose they’d manage). Meanwhile, the poorest half of the fans, or roughly 32,500 of them, would be struggling to fit into only 650 seats, representing the one percent of the seats they own. Think of it as the absolute worst musical chairs game ever. People would have to sit on top of each other, more than fifty deep, just to make the math work. This is the extent of wealth inequality in America today; only in the real world, the disparities obviously have more consequence than the distribution of stadium seats.

For a few more examples to illustrate the astounding depths of wealth inequality in modern America, consider:

- As of 2014, the four hundred wealthiest Americans were worth $2.3 trillion. This is more than double what the same group was worth a decade ago, $300 billion more than what they were worth just one year earlier,92 and $600 billion more than in 2012.93 The average member of the Forbes 400 now has 70,000 times the wealth of the typical American family, no doubt because they have worked exactly 70,000 times harder or are exactly 70,000 times smarter.94

- As of 2013, the wealthiest thirty people in the United States owned $792 billion worth of assets, which was the same amount owned by the poorest half of Americans: about 157 million people in all.95

- From 2011 to 2014, nine of the wealthiest people in America—Bill Gates, Warren Buffet, Mark Zuckerberg, the two Koch brothers and the four principal Walton heirs—gained an average of over $13 billion from capital gains on pre-existing assets. These gains did not flow from new work on their part, nor an increase in their personal productivity or particular genius. They weren’t working more hours, and they didn’t come up with some new and innovative technological breakthrough in that time. They simply owned a bunch of stuff, and over a three-year period that stuff became more valuable because of gains in the stock market. Considering that the median income for American workers was $51,000 in 2013, it would take a quarter of a million years—which is about 50,000 more years than humans have even existed—for the typical American to earn as much as the average capital gain earned by these nine people just since 2011.96

Warren Buffett and Bill Gates play table tennis against Olympian Ariel Hsing during Berkshire Hathaway’s annual shareholder meeting at Borsheims in Omaha, Nebraska on Sunday, May 6, 2012.

- For a visual understanding of what all that means, consider that if the typical American stretched his or her annual income out, in one-dollar bills, from end to end, it would stretch roughly 25,500 feet, which is about 4.8 miles. Over three years at the same income, those bills would now stretch about 14.5 miles. Meanwhile, if we took the median amount of money gained by those nine super-rich Americans mentioned above over that same three-year period, and stretched it out, in one-dollar bills, from end to end, the money chain would stretch 1.2 million miles—a money chain long enough to circle the earth forty-eight times,97 or alternately, to stretch from the earth to the moon and back twice, and then stretch around the globe a few more times for good measure.98

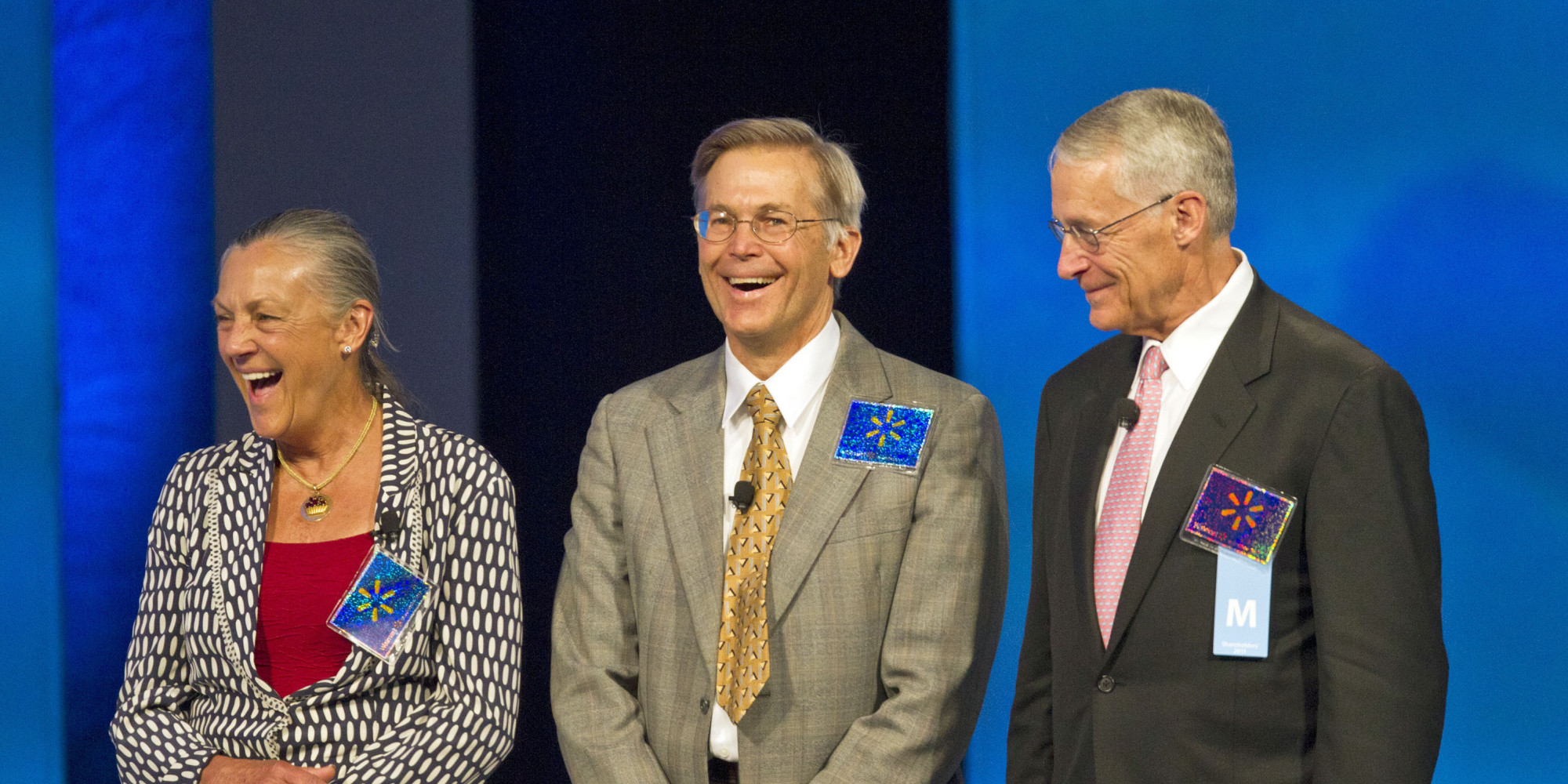

- In all, the six heirs to the Walmart fortune are worth as much as the bottom forty percent of the American population, or roughly 120 million people.99 In fact, the Walton heirs, who are rich simply because of the family into which they were born (or in the case of Christy Walton, the one into which she married), have so much wealth at their disposal that they could buy every house, condo and townhome in Seattle or Dallas or Miami and still have $40 billion to spare, with which they could buy all the homes in Anaheim, California (if they love Disneyland), or Napa (if they really like wine). Just to put the Walton’s wealth in perspective, while the six heirs could purchase every home in these major U.S. cities, someone like Oprah Winfrey (whom most people think of as fabulously rich) could only afford to buy up all the homes in Mokena, Illinois, wherever that is.100 In fact, the combined wealth of Oprah, Steven Spielberg, Donald Trump, Ted Turner, Howard Schultz (the founder of Starbucks), Mark Cuban (owner of the Dallas Mavericks), Jerry Jones (owner of the Dallas Cowboys), Phil Knight (founder of Nike), and Mark Zuckerberg (founder of Facebook)—a total of about $77.5 billion as of 2015—does not equal even half the wealth held by the Walton heirs. Even if we added the wealth of Bill Gates to the mix—the world’s wealthiest individual—the combined wealth of these ten would still fall about $15 billion short of Walton money.101 Meanwhile, most Walmart employees work for wages that leave them near the poverty line if not below it, forcing many of them to rely on food stamps to supplement their meager incomes, as we’ll explore later.

Alice Walton, Jim Walton and Wal-Mart Chairman Rob Walton, the children of the late Wal-Mart Stores Inc. founder Sam Walton, appear on stage during the company’s annual shareholder meeting in Fayetteville, Arkansas, U.S., on Friday, June 3, 2011.

Wealth disparities are especially stark when examined racially. Because of the nation’s history of enslavement, lynching, segregation and overt racial discrimination, families of color did not have the same opportunity as whites to accumulate land and other tangible assets. Although civil rights laws were passed in the 1960s to prohibit formal discrimination in employment and housing, the head start afforded to whites over many generations obviously did not evaporate simply because anti-discrimination laws were passed. Due to a history of unequal opportunity to accumulate assets,102 and the racially disproportionate impact of the recession on the real estate values of people of color,103 the median net worth of white American households as of 2011 stood at a level 15.7 times greater than the median for blacks and 13.3 times the median for Latinos.104 As for financial assets such as stocks and investments other than home equity, the ratio is nearly two hundred to one in favor of whites, with the median financial wealth for whites standing at about $36,000 and the median for blacks a virtually non-existent $200, which in most cases represents merely the money in their bank accounts.105 Even when black households are comparable to white households in terms of income, vast wealth discrepancies remain due to a history of unequal opportunity to accumulate and pass down assets. Comparing households that are middle class in terms of income, whites still have three times as much wealth as blacks, and among those in the top ten percent of income earners, white households have a nearly five-to-one advantage over black households.106 Most disturbing, white families with a high school dropout as the head of household have median net worth of $51,300, while the median for black families with college-educated heads of household is only $25,900.107 In other words, black households with heads who have a college degree have half the net worth of white households whose head finished tenth grade.

But it’s not only the weight of past racism that explains current wealth gaps. In recent years, wealth disparities between whites and blacks have been intensified because of blatant discrimination in mortgage lending. During the run-up to the housing collapse, even African American borrowers with solid credit were given subprime, high-interest loans, often by lenders who were deliberately targeting them for these purposes, such as Wells Fargo. While only about six percent of white borrowers with credit scores above 660 were given subprime loans, over twenty-one percent of blacks with comparable credit received these higher-cost mortgages.108 Most recently, discrimination testing conducted by the Fair Housing Justice Center in New York uncovered strong evidence of racial bias against potential homebuyers of color. According to a recent lawsuit against M&T Bank, prompted by the testing:

[The bank] sent out trained actors to explore whether white and non-white homebuyers would be treated differently when trying to prequalify for a mortgage. All followed a similar script, telling bank officers they were married with no children and were first-time homebuyers. The black, Latino and Asian testers presented slightly better qualifications when it came to income, credit and additional financial assets. In nine separate interactions recorded either with a camera or an audio device, employees at M&T Bank’s New York City loan office can be seen or heard treating the white applicants differently than the others, according to the suit. In one instance, a black candidate was told she did not have enough savings to buy a home. A white applicant with slightly lower income and credit scores and $9,000 less in savings was pre-approved for a loan. In another case, a Latina candidate was told she would qualify for a mortgage $125,000 less than the test’s white candidate with lower income, poorer credit and less cash.109

Although the type of disparate treatment evident in the M&T case may not be as egregious as that of Wells Fargo, which a few years ago had been deliberately steering low-income African Americans (whom they called “mud people”) into so-called “ghetto loans,” it nonetheless suggests ongoing obstacles to equal housing opportunity.110 As such, a significant portion of disparities in home ownership and net worth must be laid at the feet of discrimination in the present, and not seen merely as the residue of the past. The combined effects of past and present racial bias on the financial position of persons of color should not be underestimated as we examine why so few black and brown folks sit atop the nation’s economic structure. Of all persons in the top one percent of national wealth holders, ninety-six percent are white.111 Indeed, the four hundred wealthiest white people in America were worth approximately $2 trillion as of 2014: approximately the same amount as all forty million African Americans put together—no doubt because those four hundred white people have worked just as hard as all black people combined.112

Despite the evidence just examined, however, many continue to insist that America is a land of opportunity, and uniquely so, compared to the rest of the world. Such persons claim that even the poorest here are better off than virtually anyone else in the world, and that inequities between the haves and have-nots are smaller than they are elsewhere. But there is growing reason to doubt this rosy image. As for poverty, among industrialized nations, the United States has the third-largest percentage of citizens living at half or less of the national median income—the international standard for determining poverty. Only Mexico and Turkey rate worse among thirty-four modern, industrial democracies in terms of poverty rates.113 While conservatives claim that even the poor in America live better than the middle class elsewhere—a subject to which we’ll return in the next chapter—this argument simply isn’t true. Compared to those industrialized nations with which the United States likes to compare itself, not only are the poor here doing worse than the middle class elsewhere, they are also doing worse than the poor elsewhere, in large measure because of less complete safety nets in America. For instance, before the effect of taxes and various welfare benefits are considered, twenty-seven percent of Swedes are poor, which is slightly more than the twenty-six percent of Americans who are; but after the effects of taxes and transfers are considered, the poverty rate in Sweden plummets to only five percent, while safety nets in the United States only bring our poverty rate down to seventeen percent. Likewise, thirty-four percent of Germans are poor prior to the effects of social safety net efforts, but only eleven percent remain poor after them. In the U.K., where the poverty rate is the same as in the United States, safety nets cut poverty by more than two-thirds to only eight percent, which is twice as big a cut as that afforded by such programs in the United States.114

As for inequality compared to other nations, here too America’s contemporary record is not enviable. Among industrialized countries, the United States ranks fourth worst in income inequality between top earners and those at the bottom, and inequality here is actually growing much faster than in those other nations.115 At present, the poorest half of Americans own less of our nation’s wealth than the poorest half on the continents of Asia and Africa, and less than the poorest half in India, the U.K. and China. In other words, inequality is actually more severe in America than elsewhere.116 Importantly, it isn’t just the gap between the rich and poor in America that signifies our nation’s greater inequality relative to other countries; we also have the greatest wealth gaps between the middle class and the wealthy of any industrialized nation.117 Recent evidence suggests that this gap between the wealthy and the middle class is only getting larger, in fact; since 2010, middle-class wealth has remained flat, while wealth at the top has continued to grow, producing the largest gap between the affluent and the middle class in recorded U.S. history.118

79) Alan Dunn, “Average America vs the One Percent,” Forbes (March 21, 2012).

80) John Marsh, Class Dismissed: Why We Cannot Teach or Learn Our Way out of Inequality (NY: Monthly Review Press, 2011), 40.

81) Brian Miller, State of the Dream, 2014: Health Care for Whom? Enduring Racial Disparities (Boston: United for a Fair Economy, January, 2014): 13.

82) John Marsh, Class Dismissed: Why We Cannot Teach or Learn Our Way out of Inequality (NY: Monthly Review Press, 2011), 35.

83) Congressional Budget Office, Trends in the Distribution of Household Income Between 1979 and 2007, Pub. 4031, (Washington D.C.October 2011).

84) Emmanuel Saez, Striking it Richer: The Evolution of Top Incomes in the United States, (University of California Berkeley, September 3, 2013), 3.

85) Sarah Anderson, “Wall Street Bonuses vs the Minimum Wage,” Other Words, (March 12, 2014).

86) Les Leopold, How to Make a Million Dollars an Hour: Why Hedge Funds Get Away With Siphoning Off America’s Wealth (NY: Wiley, 2013).

87) Sylvia Allegretto, “The State of Working America’s Wealth, 2011” (Washington, DC: Economic Policy Institute, March 23, 2011), 1.

88) Anthony Shorrocks, Jim Davies and Rodrigo Lluberas, Global Wealth Databook, (Switzerland: Credit Suisse Research Institute, October, 2013), 15-16; 146.

89) G. William Domhoff, “Wealth, Income and Power,” (retrieved, September 3, 2014).

90) W. Scheidel, and S. Friesen, “The Size of the Economy and the Distribution of Income in the Roman Empire,” Journal of Roman Studies, 99 (2010).

91) “Forget the 1%,” The Economist (November 8, 2014).

92) “Forbes Announces Its 33rd Annual Forbes 400 Ranking Of The Richest Americans,” Forbes (September 29, 2014).

93) Luisa Kroll, “Inside The 2013 Forbes 400: Facts And Figures On America’s Richest,” Forbes, (September 16, 2013).

94) Sam Pizzigati, “America’s Ridiculously Rich: The 2014 Edition,” Campaign for America’s Future (October 5, 2014).

95) Paul Buchheit, “4 Shocking Examples of American Inequality,” Alternet, (February 2, 2014).

96) Paul Buchheit, “4 Reasons You Should Be Taking America’s Inequality Very Personally,” Alternet (October 12, 2014).

97) http://geography.about.com/library/faq/blqzcircumference.htm.

98) “Top Ten Things You Didn’t Know About the Moon,” Time.

99) Hedrick Smith, Who Stole the American Dream? (New York: Random House, 2013).

100) Tommy Unger, “Which billionaire could buy your city?” (Redfin Research Center, June 5, 2014).

101) “The World’s Billionaires,” Forbes (March 2, 2015).

102) Melvin Oliver and Thomas Shapiro, Black Wealth, White Wealth: A New Perspective on Racial Inequality (New York: Routledge, 1996).

103) According to a recent analysis by the Pew Research Center, from 2005 to 2009, inflation-adjusted median wealth fell by two-thirds among Latino households and by over half among black households, compared with only a 16 percent decline among white households. Mike Brunker, “Wealth in America: Whites-Minorities Gap is Now a Chasm,” NBC News (July 26, 2011).

104) Laura Sullivan, Tatjana Meschede, Lars Dietrich, Thomas Shapiro, Amy Traub, Catherine Ruetschlin and Tamara Draut, The Racial Wealth Gap: Why Policy Matters, (Institute for Assets and Social Policy/Demos, March 2015).

105) Paul Buchheit, “5 Ways Most Americans Are Blind to How Their Country Is Stacked for the Wealthy,” Alternet (November 15, 2012); Sylvia Allegretto, “The State of Working America’s Wealth, 2011” (Washington, DC: Economic Policy Institute, March 23, 2011), 10.

106) Matt Bruenig, “In Reality, Middle-Class Blacks And Middle-Class Whites Have Vastly Different Fortunes,” Demos (August 29, 2013).

107) Matt Bruenig, “White High School Dropouts Have More Wealth Than Black And Hispanic College Graduates,” Demos (September 23, 2014).

108) Algernon Austin, “A good credit score did not protect Latino and black borrowers,” Economic Snapshot (Economic Policy Institute), January 19, 2012.

109) Pro Publica, “One of the nation’s largest banks discriminates against blacks, Latinos and Asians, lawsuit claims,” Raw Story (February 9, 2015).

110) Michael Powell, “Bank Accused of Pushing Mortgage Deals on Blacks,” New York Times (June 6, 2009).

111) Stephen J. McNamee and Robert K. Miller, Jr., The Meritocracy Myth (Lanham, MD: Rowman and Littlefield, 2009), 69.

112) Bob Lord, “Dr. King’s Nightmare,” Other Words (January 15, 2014).

113) John Marsh, Class Dismissed: Why We Cannot Teach or Learn Our Way out of Inequality (NY: Monthly Review Press, 2011), 30.

114) Center on Budget and Policy Priorities, “Today’s Safety Net Cuts Poverty Nearly in Half, Provides Health Care to Millions, and Has Long-Term Benefits for Children,” Chart Book: The War on Poverty at 50, (Washington DC: Center on Budget and Policy Priorities, January 7, 2014), 11.

115) John Marsh, Class Dismissed: Why We Cannot Teach or Learn Our Way out of Inequality (NY: Monthly Review Press, 2011), 36-7.

116) Paul Buchheit, “4 Shocking Examples of American Inequality,” Alternet, (February 2, 2014).

117) Paul Buchheit, “4 Shocking Examples of American Inequality,” Alternet, (February 2, 2014); Anthony Shorrocks, Jim Davies and Rodrigo Lluberas, Global Wealth Databook, (Switzerland: Credit Suisse Research Institute, October, 2013).

118) Tami Luhby, “Wealth gap between middle class and rich widest ever,” CNN Money (December 17, 2014).